Big Data Monetization in Telecoms: Top Strategies for Revenue Growth with AI-Powered Solutions

Telcos are in a tough spot, operating in a highly competitive market with limited profit potential from traditional services. Take voice and data, for example. They are considered standard and harder to charge at a premium, with revenue from voice has dropped 80% during the past 10 years. This has led to a steady drop in ARPU. Even by trying new business models or offering unique services in other sectors, about 75% of telecom companies’ efforts haven’t generated significant new income.

Additionally, telecom companies must invest in emerging technologies like 5G, fiber rollouts, generative AI, and cloud solutions, creating a heavy financial burden. Elisa, Finland's largest telecom operator, has already seen a decline in mobile data traffic despite major 5G investments. Many other European operators struggle to maintain cash flow while covering infrastructure costs and debts, with earnings lagging behind debt levels.

Though the industry's financial outlook sends a worrying signal, we expect cash flow to stabilize once these costly upgrades are complete. Meanwhile, telecom companies are turning to mobile data monetization as a potential revenue source. Statistics show that the data monetization market is growing extremely fast with a CAGR of 19.94%.

The amount and the variety of data telcos collect about their clients is huge: from location to user patterns. To process all of this information and use it effectively businesses need data analytics. Data analytics give telcos two significant advantages: the ability to sell insights and the capacity to enhance their service offering. With anonymized data in hand, they can sell it to marketers or urban planners who use it for targeted advertising or smart urban planning or use it to improve network efficiency, reduce customer churn, and create personalized offers, all of which contribute to revenue growth.

At Flyaps, our decade of experience in the telecom industry gives us unique insights into the data telcos collect, and AI as the perfect solution to effectively analyze it. Armed with this wealth of knowledge, we're excited to discuss how operators can achieve big data monetization in telecoms and how exactly they should use AI for this purpose.

But first, let’s discuss what’s the difference between mobile data monetization and big data monetization in telecom.

What are big data monetization and mobile data monetization?

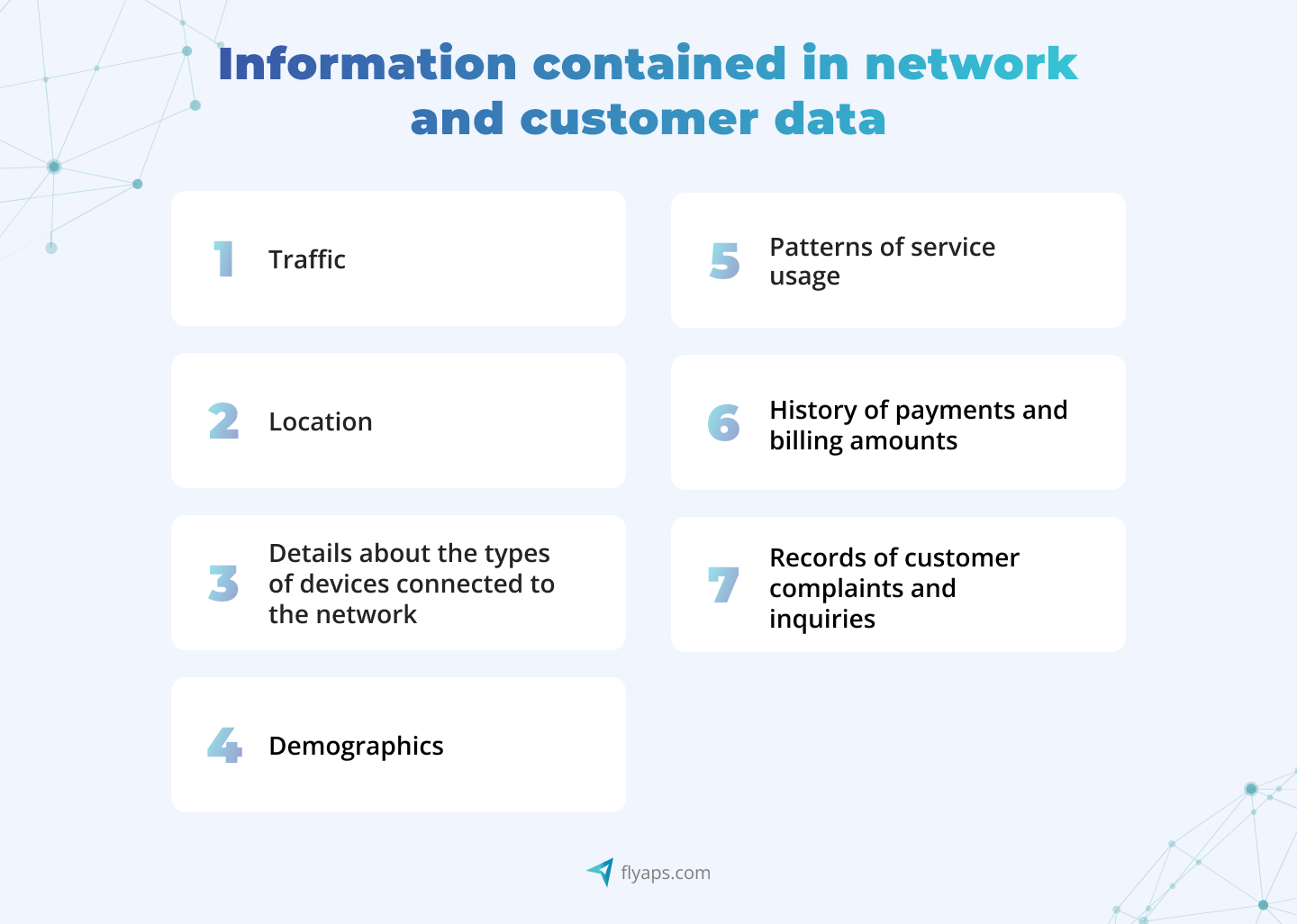

Data monetization turns the network and customer data available to telcos into new revenue streams, often by analyzing and aggregating data points. We are talking about a wide range of information, from demographics and location to payment history and complaint records.

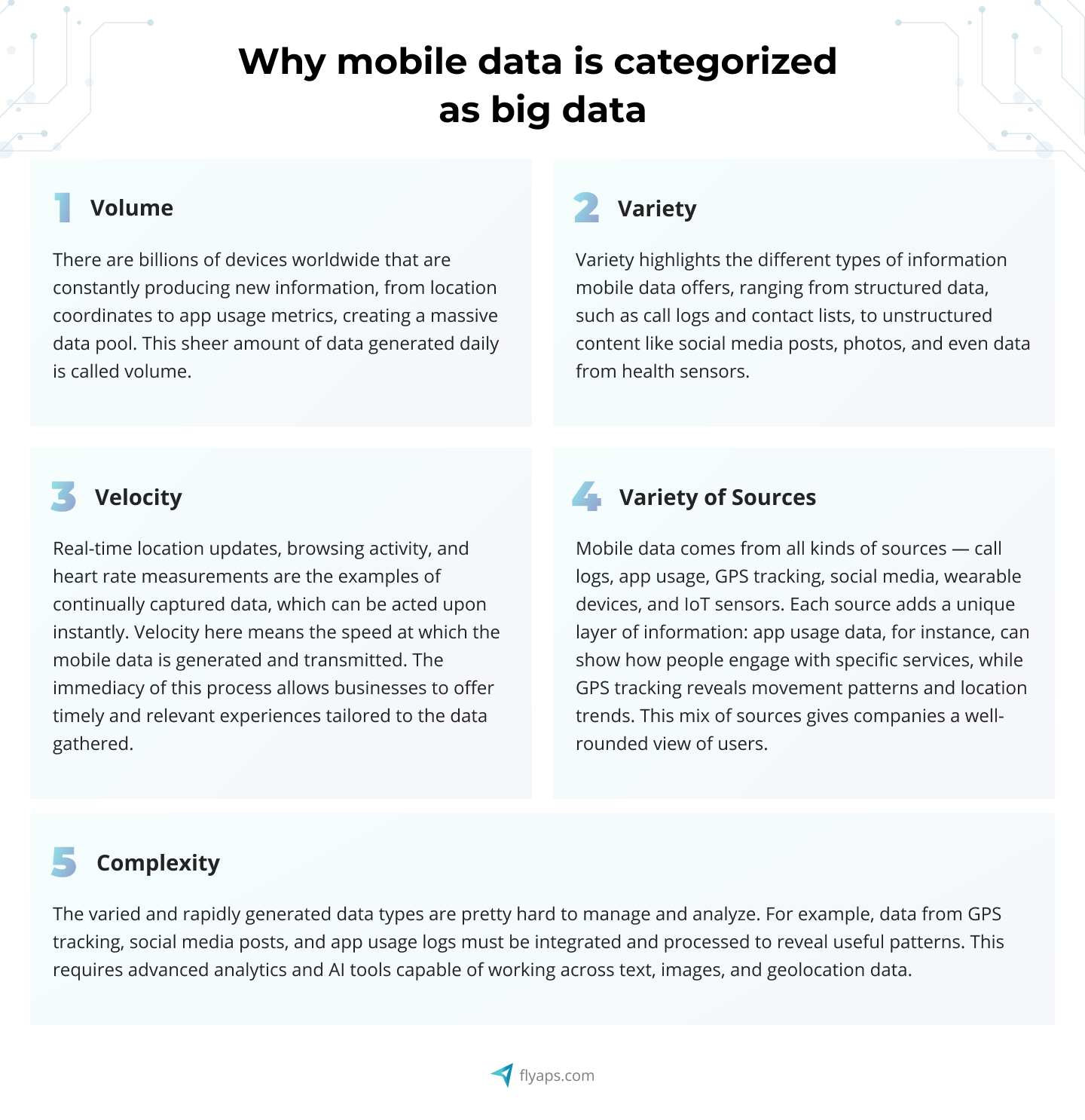

Mobile data is a form of big data and includes information generated by smartphones, tablets and other connected mobile devices. It represents the majority of all information collected by telecom operators. The fact that mobile data is essentially big data is confirmed by the fact that it shares the characteristics of volume, variety, velocity and complexity that define big data. Understanding each of these characteristics is crucial for grasping how mobile data functions as big data and how it can be leveraged in data monetization strategies.

From cloud migration to telecom-specific AI solutions, we have delivered over 20 projects that are used by hundreds of MNOs and telecom companies worldwide. Check our capabilities and let’s discuss your next solution.

See our servicesData volume

There are billions of devices worldwide that are constantly producing new information, from location coordinates to app usage metrics, creating a massive data pool. This sheer amount of data generated daily is called volume.

Variety

Variety highlights the different types of information mobile data offers, ranging from structured data, such as call logs and contact lists, to unstructured content like social media posts, photos, and even data from health sensors. For example, call logs might reveal communication patterns, while social media posts and images provide insights into user interests and social connections. This diversity allows businesses to build a better understanding of users and offer them tailored services that meet specific preferences.

Velocity

Real-time location updates, browsing activity, and heart rate measurements — are examples of continually captured data, which can be acted upon instantly. Velocity means the speed at which these mobile data are generated and transmitted. The immediacy of this process allows businesses to offer timely and relevant experiences, like a fitness app adjusting workout suggestions or a retailer sending personalized promotions as users enter a store, enhancing customer engagement.

Variety of sources

Mobile data comes from all kinds of sources — call logs, app usage, GPS tracking, social media, wearable devices, and IoT sensors. Each source adds a unique layer of information: app usage data, for instance, can show how people engage with specific services, while GPS tracking reveals movement patterns and location trends. This mix of sources gives companies a well-rounded view of users.

Complexity

The varied and rapidly generated data types we've mentioned prior are pretty hard to manage and analyze. For example, data from GPS tracking, social media posts, and app usage logs must be integrated and processed to reveal useful patterns. This requires advanced analytics and AI tools capable of working across text, images, and geolocation data.

So it's time to talk about proven strategies telcos are using to turn data into profit.

Strategic paths for big data monetization in telecoms

There are two main directions telcos can pursue for data monetization: internal (aimed at offering more services to their current customers or improving their own business operations) and external (creating new services for other companies and industries). Each of the directions can be embodied in different strategies we will talk about now.

Providing additional services to existing customers

Communications service providers have access to a wealth of customer data, ranging from usage patterns to preferences. By harnessing customer data and applying advanced analytics, they can gain deeper insights into their customers' needs and behaviors. Thanks to this knowledge, they can introduce tailored services and packages, upselling and cross-selling to their existing customer base. For example, personalized data plans, content recommendations, and bundled services can enhance customer loyalty and increase average revenue per user (ARPU).

Enhancing internal business processes

Data analytics can empower communication service providers to streamline their internal operations and reduce costs. By optimizing network infrastructure, managing customer service more efficiently, and predicting network maintenance needs, telecoms can enhance the quality of their services while reducing operational expenses. This operational efficiency not just translates into cost savings but also allows them to reallocate resources and investments into areas with higher growth potential.

Developing external data products

Externally, telcos can offer insights into customer movement patterns and demographics to industries like retail, real estate, and advertising, enabling these businesses to make informed, data-driven decisions. By providing access to data through APIs, telcos allow other businesses to integrate customer insights into their own services, often on a pay-per-use or subscription basis.

IoT data monetization strategy

By capturing and analyzing data from IoT devices, telcos can support industry-specific applications like predictive maintenance in manufacturing, fleet management in logistics, and even personalized care in healthcare. This IoT data enables telcos to tap into sectors such as agriculture, transportation, and smart cities, providing actionable insights that drive operational efficiencies and improve service delivery.

Want to understand ways of monetizing data from IoT roaming? Read our dedicated article:

Vertical-specific solutions

By creating customized data products as part of a well-defined data monetization strategy for industries like healthcare, manufacturing, and financial services, telcos can become integral partners in driving innovation within these sectors. In healthcare, for example, data from wearables and connected devices can support patient monitoring and telemedicine applications. Meanwhile, in financial services, location data from telcos can help banks authenticate transactions, detect fraud, and identify high-potential areas for new branches and ATMs.

Advertising and media partnerships

Targeted advertising and media partnerships present another lucrative path. By providing anonymized customer insights, telcos can empower advertisers to deliver personalized ads with higher engagement rates. They can also partner with media companies to provide detailed viewer insights, helping to create targeted content that resonates with audiences.

There's no need to stick to just one data monetization strategy, businesses can create their own hybrid model, betting on different potential revenue streams at the same time. However, there are some challenges they need to overcome to make any of these strategies really work.

Challenges in telco data monetization

Capitalizing on data assets in the telecom industry requires a foundation of reliable, unified, and compliant data. Without robust governance, data fragmentation, inconsistent data quality, and tightening regulations create significant barriers to monetization.

Data governance provides a solution by defining the policies, standards, and procedures that ensure data consistency, accuracy, and accessibility across the organization. It’s the very first thing telcos should set up before even thinking about capitalizing on data. However, data governance comes with a few serious challenges.

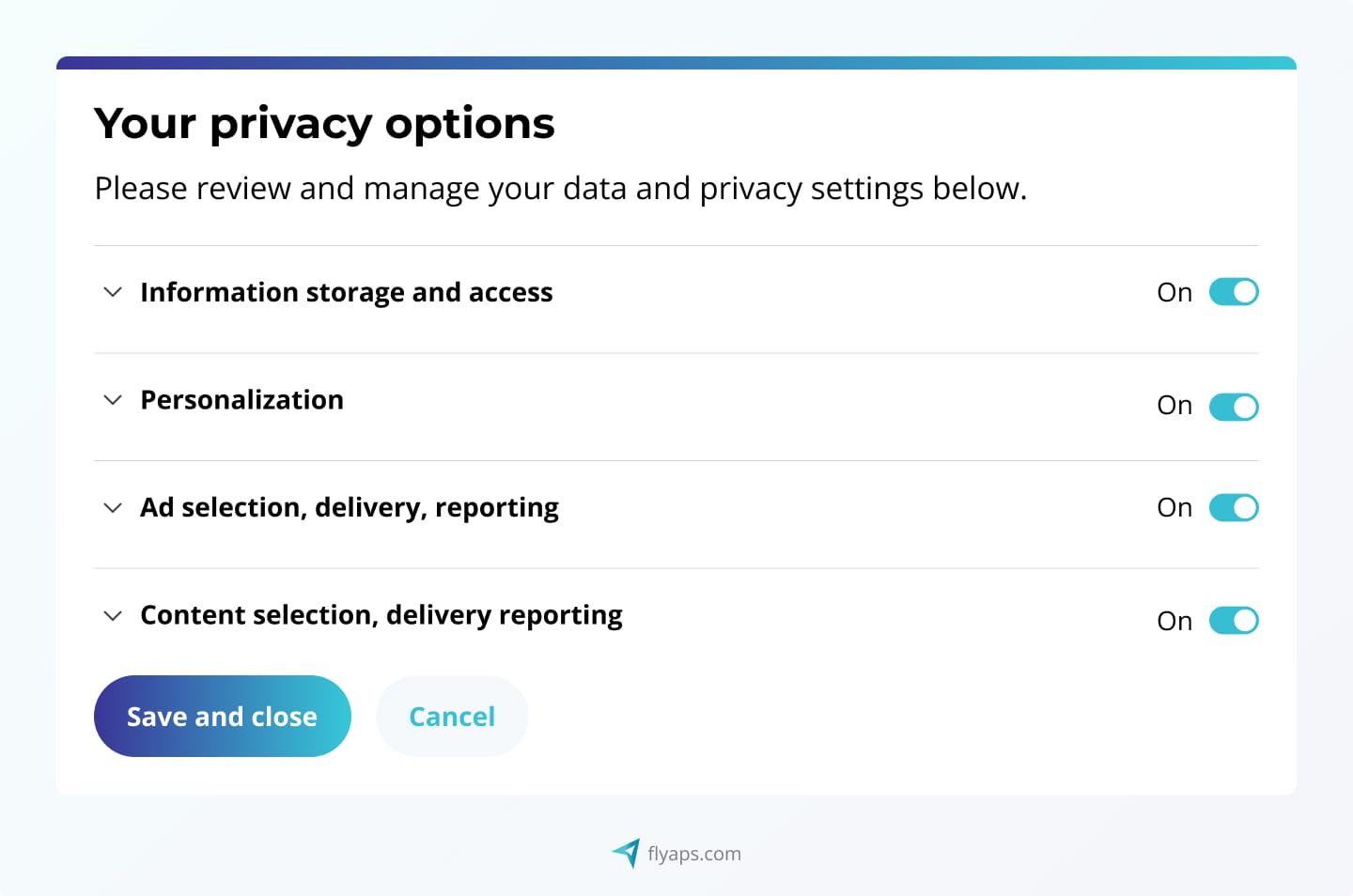

Getting users’ consent

Data privacy regulations are becoming increasingly stringent, obtaining clear and informed consent from customers is not just a best practice — it’s a legal requirement. This necessitates transparent communication about how their data will be used, stored, and shared, which can be complex in a multi-channel environment.

Want to better understand GDPR, especially for AI-related projects? Find all you need to know in our article:

Channels expansion

Secondly, critical to telco data monetization is not just the quality of the data but also the channels through which it’s delivered. Telecom companies often rely on their own customer service platforms and communication channels, but these may not be sufficient to maximize reach and engagement. By leveraging third-party channels, such as mobile wallets, e-commerce platforms, and partner applications, telcos can enhance their data distribution and create new revenue opportunities. Effective governance ensures that data shared with these third parties is handled securely and compliantly, allowing for expanded reach while maintaining customer trust.

Moreover, the integration of multiple channels, each with its own data input and output, complicates data governance. The more channels a telecom uses, the more potential touchpoints exist for data collection, sharing, and analysis.

Unified data structuring

Another important challenge is ensuring data is structured and organized consistently by the same standard across systems. A telecom company might collect data on call durations, text message volumes, and data usage from various sources. If each system formats this data differently (like one system recording call durations in seconds and another in minutes) trying to analyze usage patterns would be confusing and could lead to mistakes. An analyst could pull data from both systems and end up with flawed insights because the data wasn’t structured in a compatible way.

Investing in data analytics and data managing software

One major challenge with investing in specific software is the high cost and complexity associated with selecting, implementing, and maintaining the right tools. For effective big data monetization in telecoms, companies need powerful data managing platforms that can handle vast amounts of data quickly and accurately. At the same time, such solutions must minimize administrative costs. This requires significant upfront investment, ongoing maintenance, and skilled personnel to manage and interpret results. Additionally, if the chosen software does not fully integrate with existing data systems, it can lead to fragmented data, inefficiencies, and missed monetization opportunities.

Ensuring agility and scalability of the network

To derive actionable insights and offer real-time services, telecom networks must adapt to changing demands without compromising performance.

Big data operations like predictive analytics require networks that can scale to accommodate huge data flows and remain flexible enough to support various use cases simultaneously. However, traditional network architectures often struggle with the volume, speed, and variability of big data workloads. Investments in cloud-based and software-defined networks (SDN), as well as network function virtualization (NFV), can do the trick with the flexibility needed.

Network as a Service (NaaS) is another way to ensure agility and scalability. NaaS enables telcos to access flexible network resources on demand. This “as-a-service” model allows to scale up or down based on data processing needs, which is ideal for handling the fluctuating and often high-volume data loads that come with big data analytics.

Many of the challenges we've discussed, such as handling unstructured data and conducting complex analytics, simply aren’t solvable without the capabilities of AI. In particular, generative AI is emerging as a powerful tool for automating insights, improving decision-making, and transforming how telecoms approach service innovation. You can explore real-world applications in our article on Generative AI use cases. Therefore, let’s dive deeper into how AI makes it possible to extract value from massive datasets.

Mobile data monetization and AI

AI is heavily reliant on data, and for telecom companies, who handle massive volumes of data daily, AI is essential to unlock its true value. The vast quantities of data telcos manage are far too complex for traditional tools to process effectively. This is where AI steps in.

AI is essential for turning data into revenue and enhancing customer experience. First of all, it's the best technology for analyzing unstructured data, like text messages, call logs, or browser history, which often holds hidden patterns. Unlike traditional data tools that work well with neatly organized information, AI can handle complex, messy data to find meaningful trends.

For example, a telecom company might use AI to analyze anonymized data on customer behavior to uncover trends advertisers find valuable. By understanding patterns in browsing habits or app usage, telcos can offer advertisers insights for more targeted campaigns, generating new revenue streams while keeping customer identities protected. This allows telecoms to both improve their own services and help brands reach audiences more effectively.

Furthermore, AI can analyze network data to predict and address issues before they affect customers, creating “self-healing” networks that minimize downtime and keep services running smoothly. This proactive approach boosts customer satisfaction, which in turn can lead to increased revenue.

AI also makes it easier to segment customers based on their usage patterns, allowing telcos to tailor offerings and marketing campaigns to each group. This kind of personalized engagement is critical for building customer loyalty and maximizing the value of each user.

Final words

As revenue from traditional telecom services like voice and SMS declines, telecom companies are increasingly focusing on data monetization to unlock new revenue streams. By leveraging vast amounts of consumer data and network data, telcos can create data-driven business models that generate insights for targeted advertising, personalize customer experiences, and offer advanced data analytics services to enterprises. These data monetization initiatives not only add value internally but also attract data buyers(such as advertisers and businesses) who seek actionable data insights into customer behavior, location patterns, and usage trends.

The expansion of 5G and the growth of IoT devices provide telcos with even more data points to fuel direct data monetization strategies. With faster speeds and more connected devices, telcos can use real-time data to analyze user behavior, monitor environmental conditions, and assess equipment status. This enables predictive analytics for applications like forecasting network congestion or detecting potential technical issues before they impact customers.

Custom AI-driven data-management platforms are the best way for telcos to efficiently analyze data (even unstructured) on a large scale and extract valuable insights. To ensure scalability and meet the specific needs of telecom providers, solutions must be backed by industry and experts in AI development platforms, like Flyaps, for example. Having a solid track record of developing products that are actively used by more than 100 telecom companies, including industry leaders such as Orange Group or Yaana Technologies, our extensive experience has given us a deep understanding of the unique challenges and requirements within the telecom sector.

As part of their effective data monetization strategy, telcos are looking to become competitive data providers within the digital ecosystem. By optimizing internal processes and developing new product offerings, telcos can build competitive advantages, foster customer loyalty, and generate additional revenue through direct and indirect data monetization. In a market where most companies prioritize data-driven insights, telcos are well-positioned to increase revenues by turning their raw data into highly valued information services, aligning their business strategy with evolving digital demands.

Ready to transform your telecom business with AI-based systems for mobile data monetization? Just drop us a quick message and we will lead the way!

Skip the endless hiring cycles. Scale your team fast with AI/ML specialists who delivered for Indeed, Orange, and Rakuten.

Scale your team