5G Monetization: The Issues Telecoms Face and How to Turn Investment into Profit

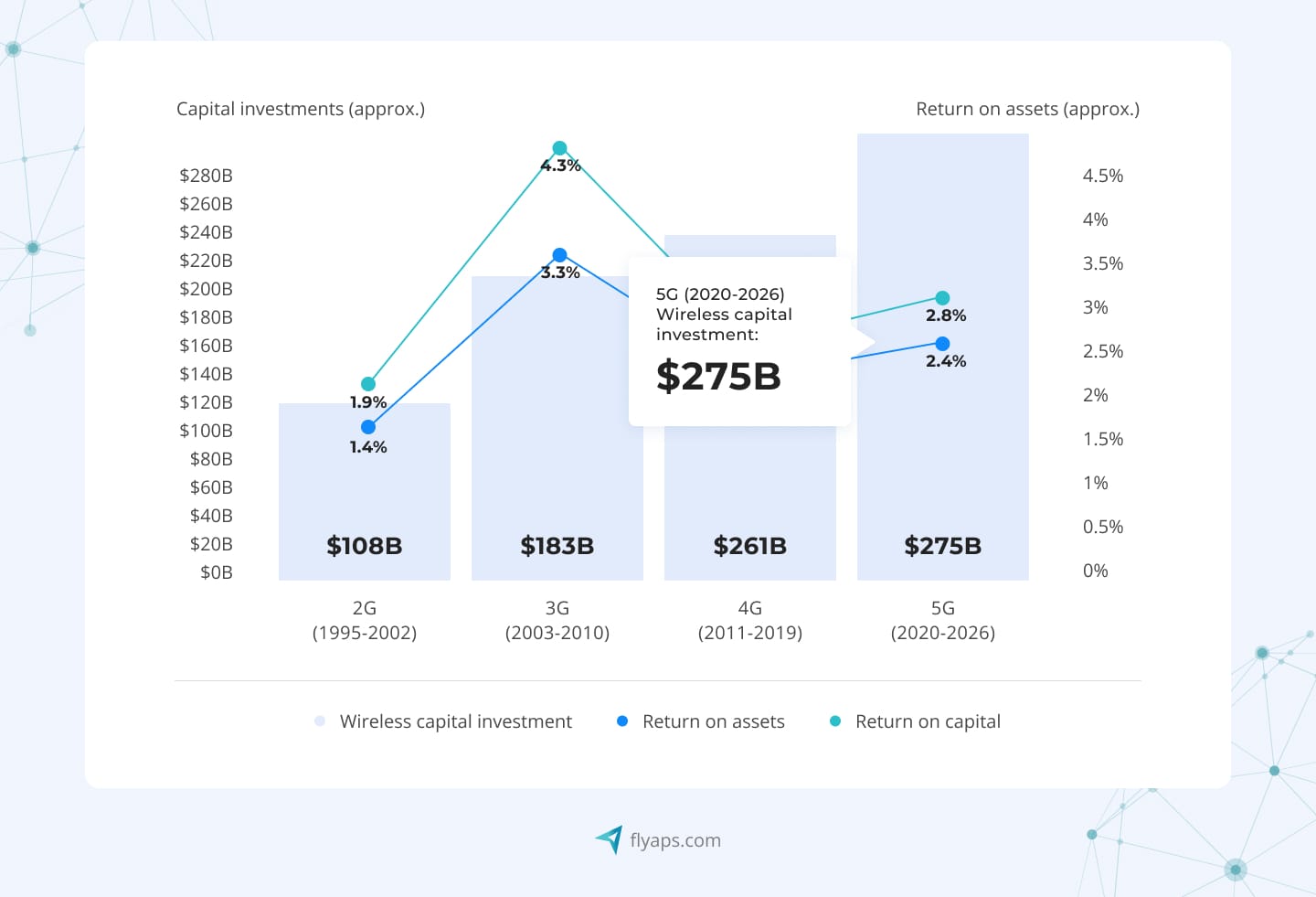

PwC’s 26th Annual Global CEO Survey revealed that 46% of telco CEOs believe that if their companies continue on their current paths, their businesses would not be economically viable in 10 years. These concerns are more than valid. If we look back at telecom profits, we’ll see that companies are spending more money on each new generation of wireless technology while their earnings aren’t growing at the same rate. In fact, after 3G, profits have been going down.

Telecoms are now searching for ways to improve returns, but the situation doesn't get any better. Network costs are rising, and gains are often less than anticipated. One thing is certain: mobile network operators (MNOs) need to come up with effective 5G monetization models to avoid another drop in revenue.

At Flyaps, we have deep expertise in telecommunications solutions, roaming, and the Internet of Things (IoT) as we have built and overhauled custom solutions for such global providers as Netspark and Yaana. In this article, we’ll examine the main reasons for telecom income drop and how operators can monetize 5G efficiently. Let’s start with a brief overview of the current situation in telecom to see how it can be solved.

From cloud migration to telecom-specific AI solutions, we have delivered over 20 projects that are used by hundreds of MNOs and telecom companies worldwide. Check our capabilities and let’s discuss your next solution.

See our services5G monetization challenges: why is telecom ROI decreasing?

With each new generation of mobile infrastructure, companies invest heavily, yet many customers, especially in the retail sector, expect to pay less while getting more. While a premium 5G business package might be a worthwhile investment for companies handling data-heavy projects, retail customers often see little value in paying more when a standard package meets their needs. This gap in perceived value makes it harder for telecoms to justify higher pricing, even though they still face the same high upfront costs for 5G infrastructure and equipment.

To address this issue, telecom companies have rolled out new 5G services like Fixed Wireless Access (FWA) and launched advanced applications like smart factories. However, these services have very different traffic needs, and meeting them is proving difficult.

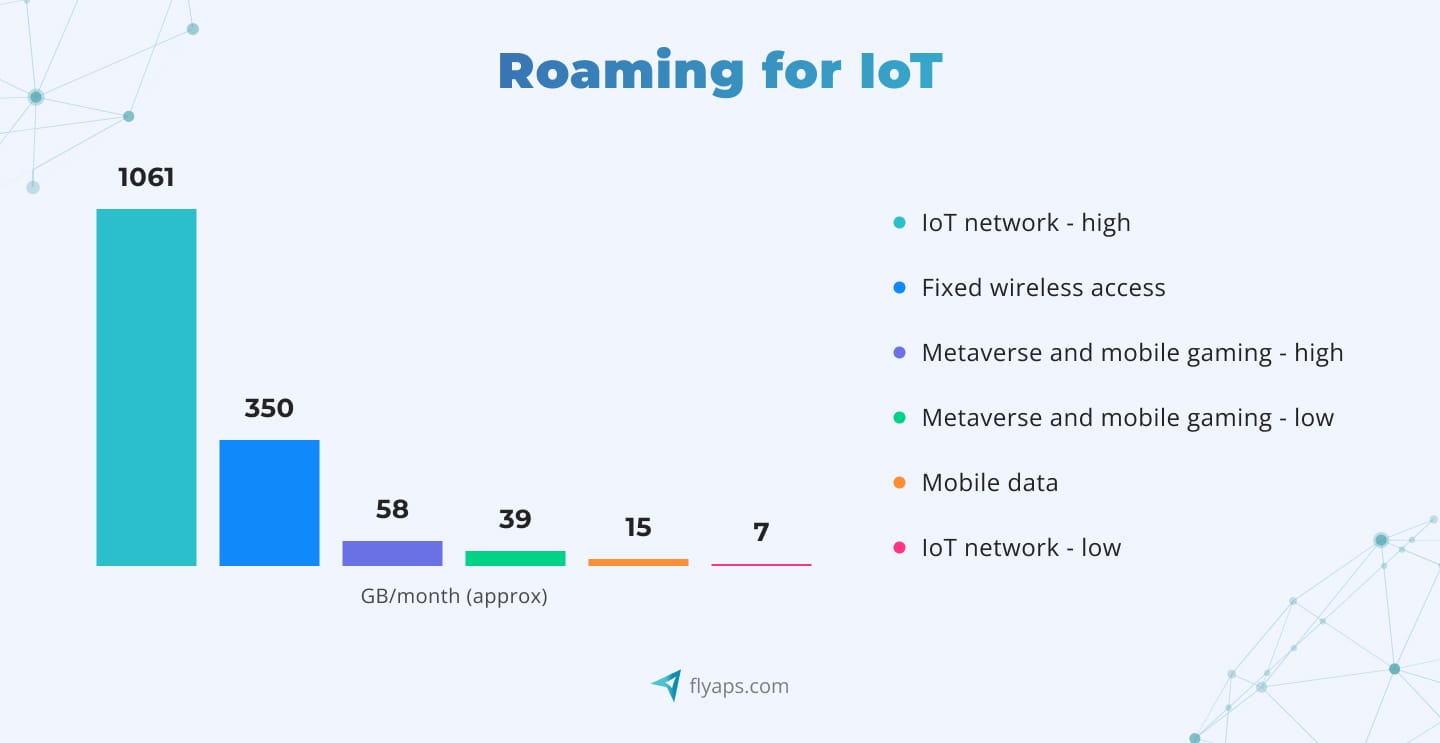

For instance, many IoT solutions – such as asset monitoring, RFID in retail, and smart meters – require low data rates and only transmit data occasionally. On the other hand, intelligent connected devices like factory robots or tools for remote surgery need extremely high bandwidth. Supporting these applications can cost up to 70 times more than mobile connection services, which makes them expensive to manage and monetize from a network perspective.

Telecoms are also on the lookout for a breakthrough service that would drive massive 5G adoption and generate significant revenue. But so far, no such thing has emerged to justify the huge investments made in 5G.

To improve their ROI, telecom companies need to take a more user-centric approach. They must first analyze what their customers actually need and tailor their offerings accordingly. Let's explore the strategies telcos can use to make this happen.

3 main roaming strategies for 5G monetization

As there is a growing demand for low-latency connections and faster data exchange, communications service providers need to come up with suitable pricing strategies meet these needs. This is especially relevant for video content, gaming, and the Internet of Things.

Let’s explore three key strategies that can help MNOs boost their 5G returns, each illustrated with real-world use cases.

1. Retail roaming

Retail roaming offers one of the most straightforward paths to successful 5G monetization. Research predicts that from 2024 to 2028 this domain will experience a 42% market growth. Why is retail roaming becoming so popular?

Its success is mostly due to new services like travel SIMs, eSIMs, and even cruise roaming.

Want to know how eSim and iSim are changing the telecom industry?

Read our article SIMs Used in Telecom (And Why Shift From Traditional SIMs to eSIMs and iSIMs.

One great example of how these technologies are impacting communication is cross-border fleet management. Imagine a logistics company with a fleet of trucks moving across different countries. They need real-time updates on the location, fuel consumption, and even maintenance status of each vehicle.

This is where tailored 5G retail roaming packages come in. Telecoms can create specific data bundles for retail companies, ensuring seamless IoT connectivity across borders. Instead of just offering a blanket data plan, telcos can create industry-specific solutions, providing a more valuable, higher-priced service. The company gets the data it needs, and the telecom generates more income from customized roaming packages.

2. Roaming for metaverse

As augmented reality (AR) and virtual reality (VR) technologies pave the way for the metaverse, telecom companies face new challenges and opportunities to provide seamless, immersive entertainment. This shift of massive internet is creating an uncharted market with immense potential for 5G monetization.

To support the metaverse, telecom operators need to deliver ultra-low-latency connections, ensuring that their customers can experience virtual worlds without lag or disruption. AR/VR applications in the metaverse require real-time data exchange and high-speed connectivity to enable everything from virtual meetings to digital shopping in hyper-realistic environments.

Telecom companies and mobile virtual network operators can capitalize on this by offering specialized roaming packages tailored to AR and VR users. For example, businesses hosting virtual events or metaverse-based services will need premium network features, such as guaranteed bandwidth and low latency roaming across borders. These customized solutions can drive new revenue streams, as companies and users are likely to pay more for uninterrupted, high-quality metaverse experiences.

3. Roaming for IoT

Among all the 5G monetization business models, IoT roaming holds the greatest potential.

Find out how telcos can gain more with IoT in our dedicated article

Capitalizing IoT Roaming for Data and Financial Clearing Houses: the Role of Cloud and AI

The sheer volume of IoT devices, ranging from wearables to industrial machines and smart homes, creates a vast market for telecoms. But simply offering connectivity isn’t enough, as these devices require consistent networks to function effectively across borders.

For example, healthcare wearables like fitness trackers or medical sensors need reliable roaming services. These devices monitor patient health in real time, and any disruption in data flow can be critical. Communication service providers can step in by offering premium IoT roaming packages tailored to healthcare providers, ensuring constant data flow wherever the patient is, even across countries. The healthcare sector values this continuity, and telecoms can capitalize on it by charging for specialized, uninterrupted services.

Similarly, in industrial IoT, manufacturers operating in multiple countries need real-time monitoring for machinery and supply chain processes. Telecoms can create bespoke roaming solutions with low-latency connections to keep these machines connected across borders.

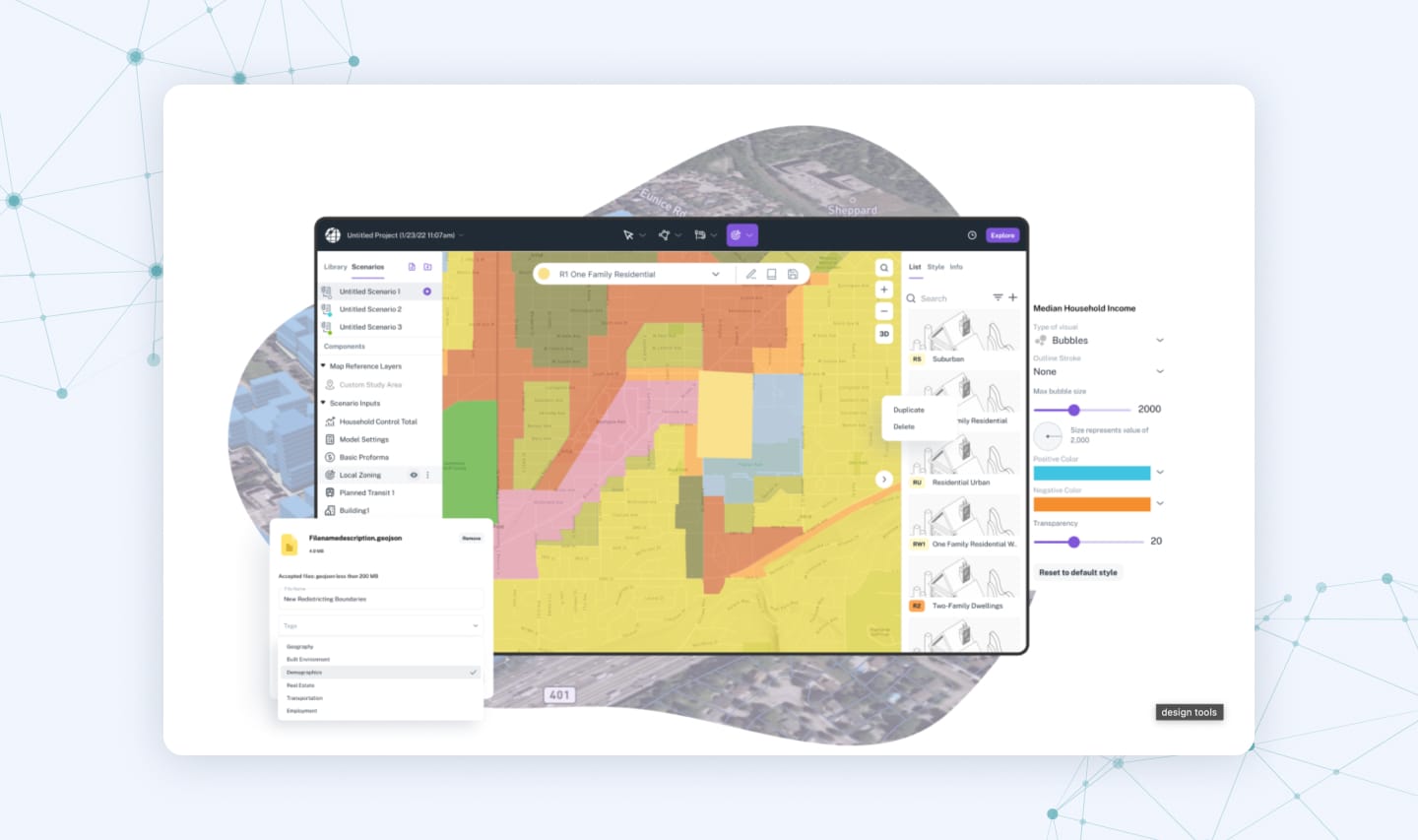

Finally, there’s a growing demand for IoT connectivity and massive machine type communications (mMTC) in urban development. Enterprises like UrbanSim, a global SaaS solution for city planning for whom Flyaps rebuilt an urban development platform, can benefit greatly from IoT devices.

Companies can collect and analyze data from infrastructure, transportation, and public utilities across multiple regions. IoT devices can monitor traffic flow, energy consumption, or even environmental data. Telecoms can offer tailored roaming solutions and new offerings that ensure these devices stay connected as they move across different areas.

These new business models unveil how telcos can gain more with 5G. But to support these services, MNOs first need to build and upgrade network infrastructure for 5G, ensuring low latency and high bandwidth. Technologies like NaaS and SDN allow MNOs to optimize network resources dynamically, offer flexible service models, and scale connectivity to meet the diverse needs of 5G applications. Here’s how NaaS and SDN allow telecom enterprises to gain more with 5G.

The role of NaaS and SDN in 5G monetization

To monetize 5G, telecom operators must focus on building flexible, scalable networks that can cater to a wide range of use cases. This is where Network as a Service (NaaS) and Software-Defined Networking (SDN) come in.

Curious about NaaS and what it can bring to the telecom sector? Find all the answers in our article: link to What is NaaS article.

Let’s see how NaaS and SDN can help telcos monetize 5G.

Network slicing with SDN

One of the key methods to monetize 5G is through network slicing, enabled by Software-Defined Networking (SDN). This technology allows operators to divide a single physical network into multiple virtual "slices," each optimized for different types of services.

Here’s how it works:

- A slice for home devices can support everyday consumer needs, such as smart home gadgets and streaming services.

- A slice for infrastructure devices can prioritize low-latency, high-reliability connections for critical services like traffic management and energy grids.

- Another slice might cater to data-heavy applications, such as cloud gaming or virtual reality.

This flexibility enables telecoms to offer tailored services to different industries and customer segments, allowing each to pay for only the specific capabilities they require.

NaaS for flexible service offerings

NaaS (Network as a Service) takes network flexibility to the next level by enabling telecoms to sell network features on demand, much like a subscription service. With NaaS, companies can pay for exactly what they need, when they need it. This opens the door to new income opportunities, including:

- Faster speeds for live-streamed events, where bandwidth requirements can fluctuate.

- Secure, reliable IoT roaming with constant connectivity for devices traveling across borders.

This model allows businesses to scale their network usage based on current needs and deliver fast service, which is especially useful in industries like entertainment, healthcare, and logistics.

NaaS and SDN in IoT and M2M communication

As 5G expands, industries are looking to leverage IoT and machine-to-machine (M2M) communication for everything from smart cities to autonomous vehicles. Telecoms can use NaaS and SDN to provide tailored services that support these critical connections. By allocating dedicated network slices for specific IoT applications and by integrating cutting-edge AI tools for developers into their network strategies they can offer stable connectivity to industries with high-performance demands.

For example, a smart city requires real-time communication to manage traffic systems, utilities, and other infrastructure. SDN allows telecoms to provide a dedicated network slice that ensures uninterrupted service for these applications. Likewise, industrial IoT, such as monitoring machinery or tracking global assets, can rely on specialized IoT packages, offering telecoms new possibilities for growth.

The role of AI in 5G monetization

Artificial intelligence (AI) has the potential to supercharge 5G monetization by automating network optimization and enhancing service delivery. Leveraging AI development platforms, telecom companies can build and deploy intelligent applications that analyze real-time data from connected devices, helping to fine-tune their networks, predict failures, and allocate resources efficiently, all while improving the user experience.

Let’s take a smart city during peak traffic hours as an example. AI can dynamically manage bandwidth across different network slices, ensuring critical services like public transportation or emergency systems maintain uninterrupted connectivity. Similarly, AI can optimize IoT networks by adjusting performance based on current needs, ensuring that industries like logistics or remote healthcare benefit from stable, cross-border connectivity.

Now that we have overlooked all key aspects of successful 5G monetization, let’s conclude with the main tips for mobile network operators who wish to boost their revenue.

5G monetization tips for telecom operators

To improve their return on investment, your telecom company should consider the following tips:

1. Analyze your 5G network costs and educate consumers

Accurately track and forecast 5G network costs for different services. Communicate these costs clearly to subscribers, regulators, and up-stack external partners to ensure fair pricing and revenue sharing.

2. Enhance service management with tailored offers

Move beyond standard connectivity plans by tailoring services to specific industries. Offer flexible pricing for applications like IoT or hourly gaming sessions, rather than generic monthly plans. Focus on immediate needs, such as secure IoT packages, while anticipating future trends like the metaverse.

3. Build new partnerships and revenue-sharing models

Form strong partnerships with cloud providers, gaming companies, and content platforms to create profitable revenue-sharing models. Build standardized APIs to streamline billing and collaboration across the industry.

Conclusion

Telecom companies face a crucial challenge in transforming hefty 5G investments into returns. If they don’t change the typical strategies to keep up with changing user needs, there’s a high chance that most mobile network operators won’t be able to survive.

To turn things around, operators need to move beyond standard plans and start offering more personalized services, like tailored IoT packages, AR/VR solutions for the metaverse, and flexible network options using SDN and NaaS. These new services can drive revenue growth, but they require a shift in strategy and strong partnerships with tech experts.

To make sure your network can offer new capabilities that users have been looking for, you should team up with a reliable tech company that has domain-specific expertise. Whether it’s IoT, roaming, or connectivity, the Flyaps team has the right skills and experience to help you build or overhaul your telecom solution. Contact us and we’ll be back to you soon to discuss your vision аnd goals.

FAQ

What are the main strategies to monetize 5G?

MNOs can introduce tailored services like IoT roaming, advanced retail roaming or network slicing to provide new value to enterprises and retail customers and guarantee great digital transformation.

What 5G monetization models can telecom companies adopt?

To gain the maximum with 5G, telcos can adopt such business models as subscription-based services, NaaS, or specialized pricing for high-demand applications such as metaverse support or IoT solutions.

What are some 5G monetization use cases?

Main 5G monetization use cases include IoT applications requiring low-latency connections, smart factories, and customized roaming services for specific needs like cruise ships or global IoT devices.

How can AI contribute to improving 5G monetization strategies in telecom?

AI plays a crucial role in optimizing 5G networks by automating resource allocation, predicting network failures, and enhancing service delivery. Telecom operators can leverage AI platforms to analyze real-time data from connected devices, dynamically manage network slices, and tailor services to customer needs - especially for demanding applications like IoT, smart cities, and the metaverse (learn what it takes to build such AI solutions in 2025). For a deeper understanding of the technologies behind AI implementation in telecom and beyond, check out our comprehensive guide on the "AI tech stack".

Can generative AI open new monetization opportunities for telecom providers?

Absolutely. Generative AI can enable telecoms to develop new revenue streams by powering intelligent virtual assistants, automating customer interactions, generating dynamic service bundles, and even creating hyper-personalized marketing campaigns. It also plays a role in content generation for customer engagement and network optimization insights. To explore more ways this technology is transforming industries, check out our detailed overview of generative AI use cases.